The core question of this article — is Gracexfx.com truly a broker worth trusting? — demands more than surface-level answers. We break down regulation, platform performance, account types, and real trader feedback to separate substance from marketing.

Strong Licensing Backing and Client Protection

One of the first trust indicators for any broker is its regulatory status. Gracex is registered and regulated under license number L15817/GL by the Union of Comoros (Anjouan), a recognized offshore financial jurisdiction. While not at the tier-one level like FCA or ASIC, Anjouan imposes minimum capital requirements and mandates client fund segregation, meaning customer deposits remain untouched by the broker’s operational costs. Gracex also claims adherence to global financial compliance protocols, adding a layer of operational discipline.

In the context of Gracexfx.com reviews, this regulatory base helps justify a moderate level of trust — but isn’t equivalent to top-tier supervision.

Account Types Tailored for Different Trader Profiles

Gracex offers a diverse account lineup structured around both deposit capacity and trading strategy:

- FREE Account — Requires up to $500. No monthly fee, ideal for testing strategies with smaller capital.

- ZERO Account — Charges $100/month, but features raw spreads from 0.0 pips and zero commissions.

- FIX Account — Offers fixed spreads starting at 3 points, suitable for predictable cost modeling.

- CENT Account — $10/lot fixed cost, designed for micro-lot and cent-based strategies.

This flexibility shows Gracex’s intent to serve both beginners and advanced users — a practical step toward being considered “trustworthy” in real-world terms.

Trading Conditions: A No-Conflict Environment

Gracex emphasizes pure STP (Straight Through Processing) execution — meaning orders are sent directly to liquidity providers without dealer desk interference. This removes conflicts of interest, as the broker doesn’t profit from client losses. Other notable features include:

- 0% trading commissions on most accounts

- No swap fees, facilitating overnight positions

- Spreads from 0.00 pips, especially attractive to scalpers

Execution speed and price transparency are central to many Gracexfx.com reviews, often highlighted as competitive advantages.

Technological Backbone: MetaTrader 5 Ecosystem

The broker deploys MetaTrader 5 across WebTrader, iOS/Android, and PC terminals. This platform enables algorithmic strategies, advanced charting, and expert advisor (EA) integrations. Gracex positions itself as a tech-first broker — and in this area, they deliver. Even traders with modest experience can use indicators, backtesting, and one-click execution without being overwhelmed.

This fusion of deep functionality with a clean UI supports the core question — yes, Gracex is building a user-friendly but capable trading environment.

Diverse Market Coverage

Gracex’s asset library includes:

- Forex: All major pairs plus exotics

- Metals: Gold, silver, platinum

- Indices: S&P 500, DAX, Nikkei, and others

- Energy: WTI, Brent

- Crypto: BTC, ETH, and altcoins

- Regional CFDs: by continent, including Asia and LatAm

For users browsing Gracexfx.com reviews for asset diversity, the broker meets the bar — particularly in offering regional CFDs, which remain rare.

Extras: Copy Trading, PAMM, and Market Education

Gracex strengthens its offering with several value-added tools:

- Copy Trading & Social Trading — Ideal for newcomers. Investors can auto-follow seasoned traders without deep market knowledge.

- PAMM Accounts — Managed by experienced professionals; suitable for passive exposure.

- Education & Analytics — Resources range from beginner guides to advanced webinars and daily market overviews.

- Bonuses — Regular promotions for new signups and deposit matches.

These tools show Gracex’s commitment to both onboarding new traders and retaining advanced users — further reinforcing trust via practical support.

Awards That Back Their Claims

In 2024, Gracex was named:

- The Fastest Growing Broker — World Financial Award

- The Best Customer Support — Forex Brokers Association

While awards should never be a sole trust metric, they do confirm the broker’s upward trajectory and strong customer service — two frequent positives in trader feedback.

In reviews of Gracexfx.com, fast growth is often viewed not as a red flag, but as a sign of responsive product-market fit.

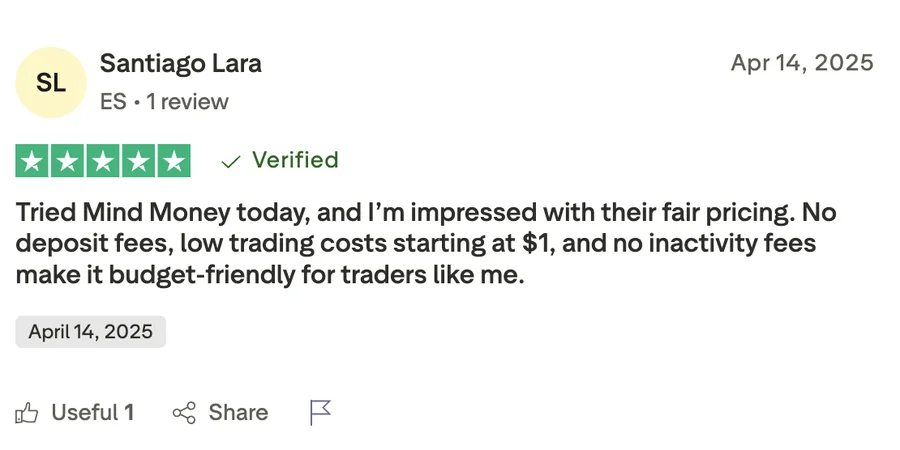

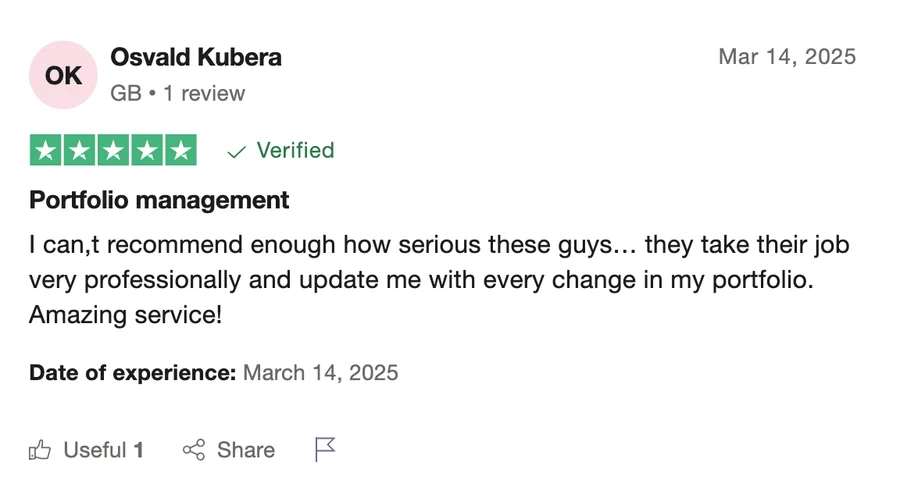

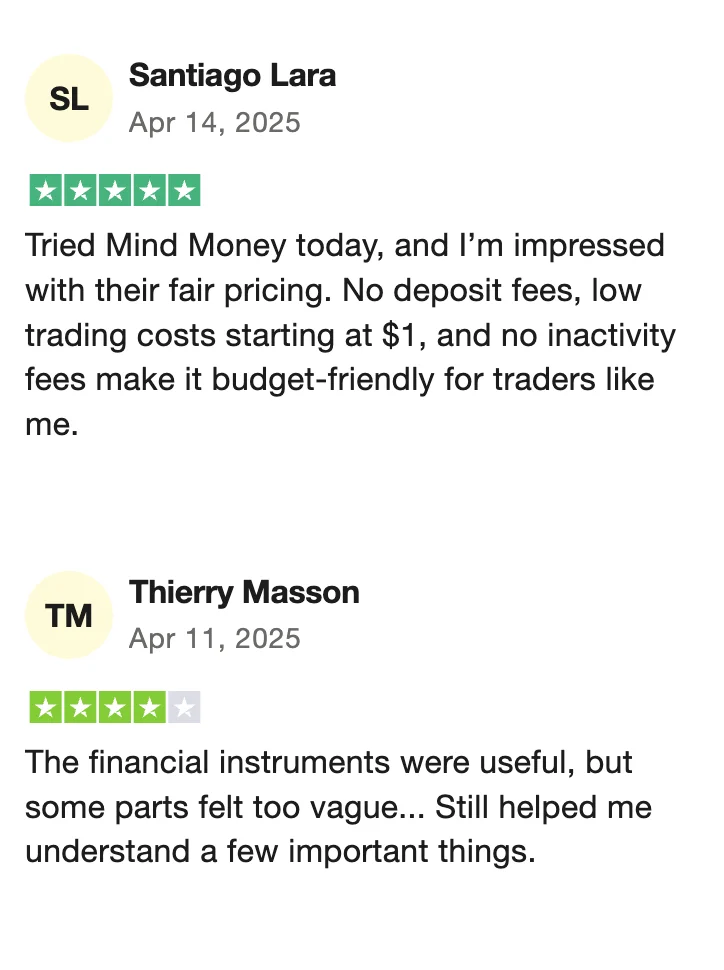

Trader Feedback: What Reviews Actually Say

We examined sources like Trustpilot, Reddit, and ForexPeaceArmy. Here’s a breakdown of recurring themes:

- Positive: Fast order execution, MT5 performance, Copy Trading simplicity, responsive support

- Negative: Offshore licensing concerns, occasional KYC delays, no US clients accepted

Most complaints fall under onboarding procedures, not execution or fund withdrawals — indicating structural, not operational, flaws.

This supports a “conditionally trustworthy” verdict — a reasonable conclusion from available Gracexfx.com reviews.

Risk Analysis: What You Should Know

No broker is without risk. Key considerations include:

- Jurisdiction: Anjouan is offshore, so dispute resolution could be slower than with EU brokers.

- Market risk: Trading remains speculative; users should understand leverage and volatility.

- Operational: Always check withdrawal processing time and compliance documentation.

Mitigate risks by using small initial deposits, verifying all account terms, and testing execution via demo or FREE account.

Conclusion: What Turned Out True — and What Was Just Marketing?

So, is Gracexfx.com a broker worth trusting? In most functional categories — platform, execution, education, and tools — the answer leans toward yes. Regulation is offshore but credible enough for moderate-risk profiles. Add-ons like Copy Trading and flexible accounts empower both novices and professionals. That said, cautious onboarding and moderate deposits are advisable until personal experience confirms platform reliability.

Ultimately, the verdict is: Gracex is worth trusting — with informed expectations.