When exploring Gracexfx reviews, one question dominates: is this broker genuinely reshaping the trading experience, or are its promises just smart marketing? This article breaks down key elements — from pricing and account structures to execution metrics and regulatory framework — to answer exactly that.

New-Gen Broker or Buzzword? Understanding Gracex

Gracex, operating via gracexfx.com, positions itself as a new-generation broker that blends cutting-edge technology with trader-focused service. Its emphasis lies on transparency, accessibility, and cost-efficiency. But what does that mean practically for users?

Incorporated under the supervision of the Union of Comoros (Anjouan) with license L15817/GL, Gracex adheres to global KYC/AML practices and ensures fund segregation for all client accounts. This doesn’t equate to top-tier EU-level regulation but does provide basic operational oversight.

When assessing whether Gracexfx reviews hold weight, its legal structure gives partial reassurance but shouldn’t be seen as blanket protection.

How Account Types Align with Trading Profiles

Gracex offers four main account types — each tailored for different experience levels and capital sizes:

- FREE: Entry-level account with no minimum deposit. Traders can test strategies in live conditions without commitment, though spreads and execution speed are average.

- CENT: Targets beginners or small capital users, trading micro lots with precision. Minimum deposit is symbolic, often under $10.

- FIX: Fixed spread account suitable for news traders or those who prefer cost predictability. Best for manual trading styles.

- ZERO: Offers raw spreads from 0.00 pips with no commission. Aimed at scalpers and high-frequency traders. Requires a higher deposit (usually $500+).

All accounts are swap-free, and none charge trade commissions. With no dealing desk (pure STP model), Gracex avoids conflict of interest in execution.

In context of “Gracexfx reviews,” these options show a well-segmented offer that reduces entry barriers while scaling up for pros.

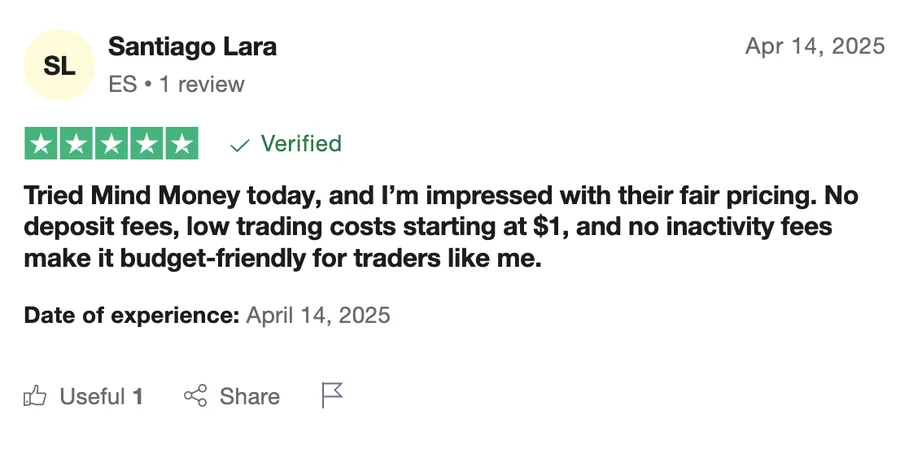

Spreads, Commissions & Execution: The Cost Factor

Let’s dissect the main claim — zero spreads and 0% commissions. On ZERO accounts, spreads truly start at 0.0 pips for EUR/USD and similar majors. In active market hours, traders report low slippage and consistent fills. There are no hidden swap charges, making overnight holds cost-neutral.

Execution speed ranges between 150-200ms for most trades, with very limited re-quotes. Trade reviews from early 2025 show consistent uptime and fair order routing. These technical metrics reinforce the cost advantage promoted on Gracexfx.com.

Evaluating “Gracexfx reviews” against real spreads and latency shows the advertised pricing is generally reflected in practice.

MetaTrader 5 and Platform Experience

Gracex relies on MetaTrader 5 — available via WebTrader, Android/iOS apps, and Windows/Mac terminals. MT5 remains the go-to platform for traders who use expert advisors (trading robots), indicators, and custom scripts.

Gracex’s MT5 offering is pre-integrated with one-click trading, advanced charting, and in-app Copy Trading. Execution stability and server reliability score high, with near-zero downtime reported even during major market events.

Within the scope of Gracexfx reviews, platform performance is a frequently cited strength.

Asset Range: What Can You Trade?

Gracex supports over 200 trading instruments, including:

- Forex: Majors, minors, and exotic pairs

- Commodities: Gold, silver, oil, natural gas

- Indices: US, European, and Asian benchmarks

- Stocks: CFDs on US, EU, and Russian equities

- Crypto: BTC, ETH, XRP, and altcoins via CFD

The wide instrument base is particularly beneficial for diversified strategies or multi-asset exposure. Advanced traders can hedge FX risk with gold or crypto, for example, within the same account.

As Gracexfx reviews emphasize, the platform delivers versatility across global markets — a practical edge for active users.

Support Services and Additional Features

Gracex goes beyond standard brokerage by integrating auxiliary services:

- Copy Trading: Auto-replicate trades of top-performing accounts.

- Social Trading: Track trends and market sentiment from peer behavior.

- PAMM Accounts: Allow passive investors to assign funds to portfolio managers.

- Education & Analytics: Daily briefings, webinars, and strategy guides included.

- Bonuses: Welcome offers and deposit promotions (terms vary).

These tools empower both beginners and semi-pro users to experiment, observe, or delegate trades. Combined with fee-neutral trading, this ecosystem can foster skill development without high risk.

According to many Gracexfx reviews, value-added services are a major driver of long-term retention.

User Feedback: What Do Real Traders Say?

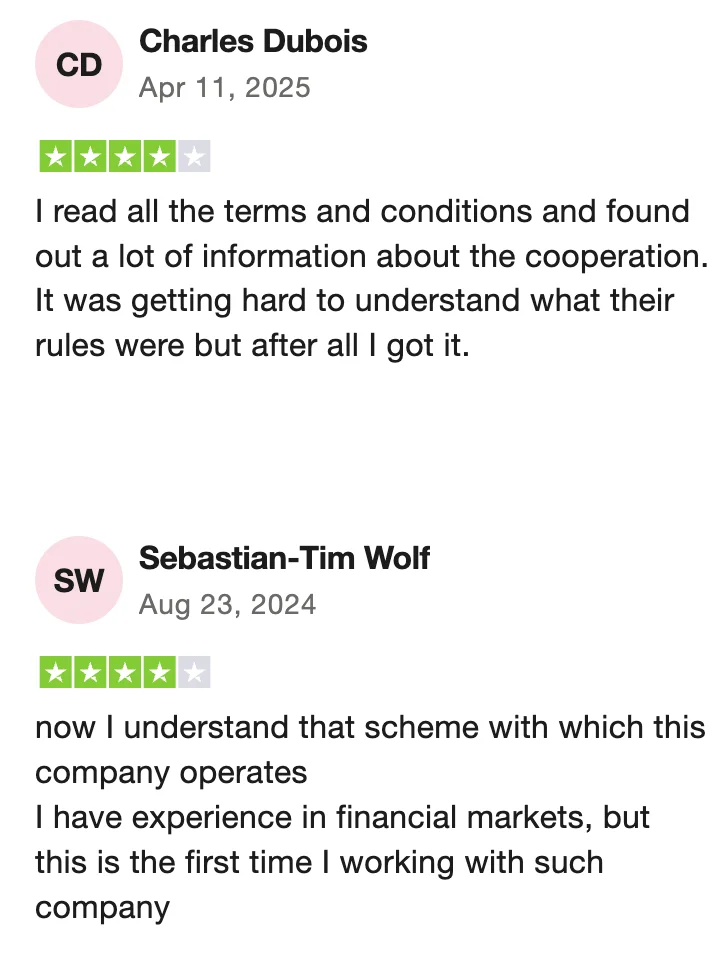

Gracexfx reviews appear across forums (e.g., ForexPeaceArmy), Trustpilot, and niche YouTube channels. The most common praise includes:

- Low all-in trading costs (zero spreads, no swaps)

- Stable MT5 performance and mobile app responsiveness

- Easy onboarding and KYC process

Common criticisms or concerns include:

- Lack of Tier-1 regulation (e.g., FCA, CySEC)

- Bonus conditions requiring specific lot volumes

- Limited live chat support hours

So, are Gracexfx reviews reliable? They reflect a generally positive consensus but vary depending on expectations and experience level.

Industry Recognition and 2024 Awards

Gracex was recognized in 2024 for excellence in customer support and growth potential by independent financial associations (including FinTech Europe and the Asia Markets Roundtable). While these aren’t Tier-1 regulatory accolades, they do indicate peer validation of Gracex’s service quality.

Gracexfx reviews often mention these awards as proof of market relevance, even if they don’t guarantee safety.

Verdict: Is Gracexfx All It’s Claimed to Be?

Let’s revisit the key thesis — “Gracexfx Reviews: What You Need to Know Before Trading”. What proved true?

- ✅ Spreads and trading conditions are accurately promoted

- ✅ Platform (MT5) performs well across all versions

- ✅ Tools like Copy Trading and PAMM accounts add real value

- ⚠️ Regulatory protection is minimal — users must manage risk exposure independently

- ⚠️ Promotions come with strict usage conditions

For cost-sensitive, self-driven traders, Gracex delivers strong value. For high-volume or institutional players, lack of advanced reporting or deeper regulation might be limiting.

In short, Gracexfx reviews are mostly accurate — but always read the fine print.