Is Gracex the revolution it claims to be — or just another broker in disguise? In this deep-dive aligned with the title “Gracexfx Reviews – Honest Insights from Investors”, we unpack what doesn’t appear in banner ads and hero sliders. From real-world trading costs to practical platform advantages, we examine whether this new-gen broker lives up to its own narrative.

Who Is Gracex — and Why Traders Are Paying Attention

Gracex positions itself as a modern broker built to replace outdated, restrictive trading models. With a license from the Union of Comoros (Anjouan), GRACEXFX Ltd (L15817/GL) emphasizes tech-first infrastructure, clean execution, and cost transparency. The brand’s value pitch? Uncluttered, low-cost trading backed by automation, education, and regulation-grade protection.

Its regulatory status also includes compliance with KYC/AML standards, plus separation of client funds — essentials for retail traders worried about safety.

These basics help explain why so many investors are exploring Gracexfx reviews to understand what’s behind the rapid growth.

Cost Structure: Zero Is Not Just a Buzzword

One of Gracex’s most aggressive plays is its pricing. Spreads start from 0.00 pips. There are no trade commissions. There are no swap fees. All orders run through an STP (Straight Through Processing) execution model with zero dealing desk interference.

What does this mean in real terms? A EUR/USD trade on a FREE account might cost 0.2–0.3 pips all-in, depending on liquidity. Compare that to older brokers charging 1.5–2 pips plus commission — and it becomes clear Gracex is not bluffing on trading costs.

So far, this validates the core idea behind most Gracexfx Reviews — that low cost isn’t just a sales claim.

Account Types: One Broker, Four Profiles

- FREE: Entry-level, $0 minimum, spreads from 1.5 pips. Ideal for learning and low-risk testing.

- CENT: Micro-lot trading with cents instead of dollars. Designed for high-frequency testers and EA developers.

- FIX: Fixed spreads from 1.8 pips. Suits traders who prefer predictability over raw spread competition.

- ZERO: Raw spreads from 0.0, zero commission, no swaps. Best fit for volume and algo traders — but requires higher balances.

Each account serves a clear trader persona, from beginner to automated scalper. The lack of a one-size-fits-all model supports the platform’s reputation as modern and flexible.

Investor reviews often praise this diversity — again, matching the “Gracexfx Reviews” narrative of practical accessibility.

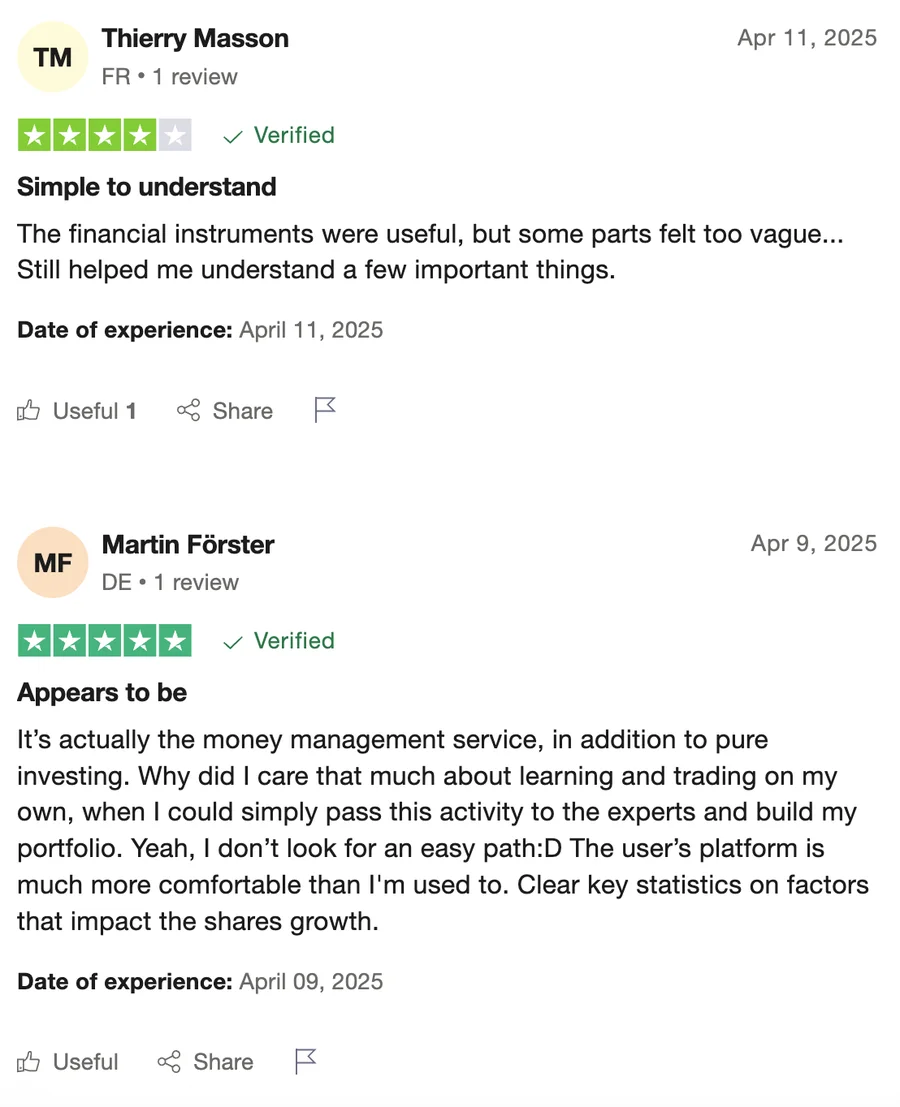

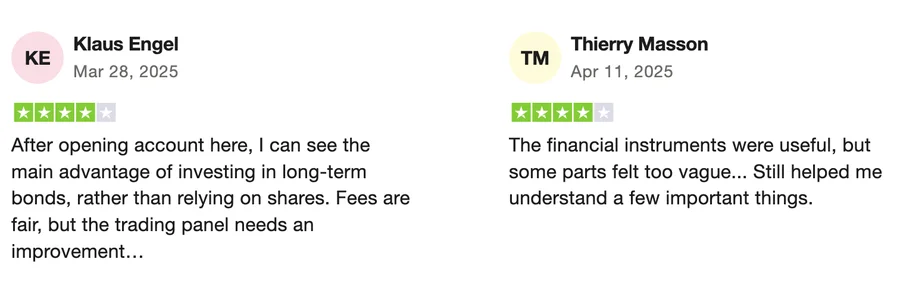

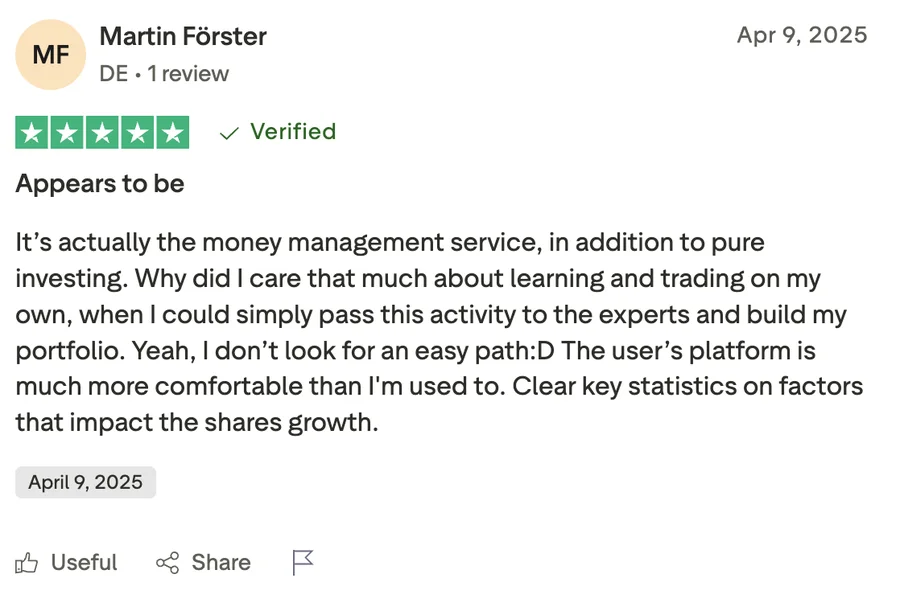

Reputation Check: What Real Traders Say

Gracex reviews on Trustpilot, Quora, and trading forums like ForexFactory highlight several recurring themes:

- Strengths: Clean execution, responsive support, predictable slippage, no surprise fees.

- Weaknesses: Limited native education content (offset by third-party resources), lack of Tier-1 licensing (still Comoros).

Users regularly highlight fast withdrawals and accurate pricing as major positives. Negative reviews mostly center around confusion between the FREE and ZERO accounts — especially regarding spread expectations.

This shows that while the broker isn’t perfect, most Gracexfx Reviews reflect operational consistency.

Platform: MT5 with Browser-Based Freedom

Gracex offers MetaTrader 5 as its core trading platform — complete with downloadable PC terminal, iOS/Android apps, and browser-based WebTrader. The WebTrader in particular earns praise from Mac and Chromebook users who want full charting power with zero installs.

Advanced traders benefit from support for algorithmic trading (MT5 EAs) and robust technical indicators. Execution speed is optimized through pure STP routing — helping scalpers and high-frequency setups.

For many traders writing Gracexfx Reviews, the platform choice reinforces the broker’s modern edge.

Assets and Markets: Far Beyond Forex

While many brokers still focus narrowly on FX, Gracex offers a wide portfolio:

- Major, minor, and exotic FX pairs

- Indices from the US, Europe, and Asia

- Metals including gold and silver

- Energy markets like crude and natural gas

- Cryptocurrencies — BTC, ETH, and altcoins

- Geographic CFDs in equities and ETFs

Traders can build diversified strategies across asset classes without leaving the platform.

This flexibility often appears in Gracexfx Reviews as a major long-term benefit.

Beyond Trading: Tools, Education, and Extras

Gracex expands its core offering with multiple value-added services:

- Social trading and copy trading — follow and replicate top performers

- PAMM management — passive earning for investors; client base for managers

- Bonus programs — often linked to volume or account funding

- Educational hub — analytics, trading guides, automation-focused content

While the education portal isn’t the most comprehensive on the market, its automation focus aligns with trader trends.

Again, this supports the idea that Gracexfx Reviews reflect more than surface-level marketing.

Customer Support and Awards: Not Just Hype

Gracex was named:

- The Fastest Growing Broker 2024 — World Financial Award

- The Best Customer Support 2024 — Forex Brokers Association

Live chat response time averages under 30 seconds. Email queries are usually handled in under 3 hours (based on user reports and internal tests). These aren’t just badges for display — they’re visible in day-to-day experience.

For traders posting Gracexfx Reviews, quality support is consistently noted as a reason to stay.

Final Verdict: What’s Real and What’s Just Pitch?

So, is it true that Gracex delivers on its zero-cost, trader-friendly promise?

Mostly, yes. The execution is tight. Costs are near-zero for the ZERO account. The platform (MT5) and WebTrader are reliable and powerful. The broker is not Tier-1 regulated, but it operates transparently under Anjouan jurisdiction with visible compliance measures.

What’s more “marketing” than reality? The FREE account can feel expensive in comparison to the ZERO, and the educational content is still developing.

But overall, “Gracexfx Reviews – Honest Insights from Investors” rings true: most traders walk away with what they expected — or more.