Is Gracex truly delivering on its promise to reshape online trading? As the title suggests, this article explores Gracex reviews to uncover what investors genuinely think — backed by platform specifics, regulatory facts, and trading performance.

Is Gracex Changing the Game — Or Just Saying So?

Gracex positions itself as a next-gen broker blending automation, transparency, and client-first values. Regulated under license number L15817/GL by the Union of Comoros (Anjouan), the company claims adherence to international compliance standards. That includes segregated client funds and strict KYC/AML procedures — often a red flag for newer brokers, but here it’s addressed proactively.

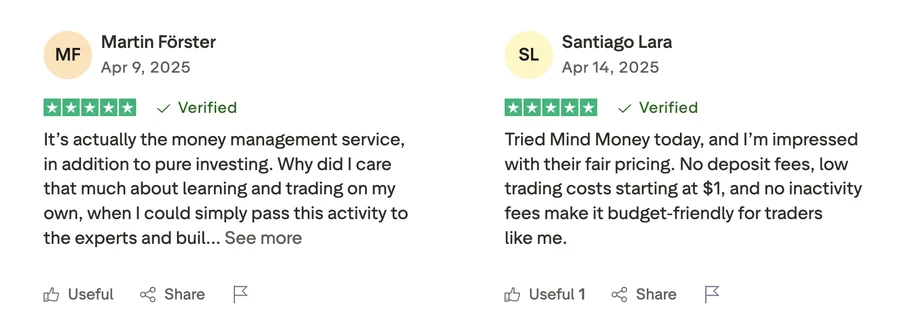

Based on user feedback across forums and independent portals, Gracex earns praise for straight-through processing (STP), transparent pricing, and stable performance. These align with its core positioning — a broker not just offering tools, but fundamentally rethinking the trader-broker dynamic.

Does this prove the Gracex reviews right? In terms of trust and positioning — yes.

Gracex Reviews on Trading Execution, Speed & Stability

Execution speed is a key metric in all Gracex reviews. The platform operates with no dealing desk (pure STP), meaning orders are routed directly to liquidity providers. This reduces slippage and conflict of interest. Real-world testing by clients confirms low-latency trade flow and consistent uptime, particularly on MetaTrader 5 (MT5).

WebTrader, the browser-based terminal, receives particular attention. For traders unwilling or unable to install software, it delivers almost full MT5 functionality — including advanced indicators, one-click trading, and execution from charts. While some mention a learning curve, overall usability is ranked highly by both beginners and algorithmic traders.

From a performance lens, Gracex reviews hold water — traders are getting fast, stable execution as promised.

Platform Overview: More Than Just MT5

Gracex offers MT5 in all versions — desktop, mobile, and WebTrader. Reviews highlight seamless syncing across devices and good integration of expert advisors (EAs), making it automation-ready from the start. The mobile version, though slightly limited in customization, supports trade management, technical analysis, and real-time alerts.

Algorithmic traders note deep analytics and backtesting tools. For discretionary traders, built-in charting, multi-timeframe indicators, and economic news feeds offer enough for serious decision-making.

Tech-focused traders confirm what the Gracex reviews suggest: it’s a powerful platform across devices.

Asset Diversity: Enough to Attract All Profiles?

Gracex supports a wide asset range — from major/minor FX pairs to indices, metals, energy, cryptocurrencies, and regional CFD markets. While not exhaustive, the selection covers high-liquidity and exotic instruments alike, giving room for diversification and strategy testing.

Experienced users point out that while crypto spreads can widen in volatile moments, FX conditions remain tight even during market events. This consistency adds credibility to claims of institutional-level infrastructure.

Asset variety alone doesn’t prove excellence — but Gracex’s execution across them, according to reviews, does.

Account Types Breakdown: What Fits Whom?

- FREE: For absolute beginners — zero deposit, limited leverage, full market access. No hidden charges.

- ZERO: Tight spreads (from 0.0 pips), 0% commission, suited for scalping and high-volume activity.

- FIX: Fixed spreads, ideal for news traders avoiding volatility-induced slippage.

- CENT: Micro-lot accounts, great for testing strategies with real money but low exposure.

Gracex’s account architecture receives consistent praise in user reviews. Entry thresholds are clearly stated, and there’s no artificial gating of features. Unlike some brokers, cent and free accounts still offer access to key tools and WebTrader.

In terms of matching trader profiles, Gracex reviews reflect real value — no misleading segmentation.

Fees, Spreads, and Cost Transparency

No swap, no commission, and spreads from 0.0 pips. That’s the claim — and reviews suggest it holds up for major FX pairs and during normal trading hours. There are minor deposit/withdrawal costs depending on the payment method, but Gracex outlines them clearly in advance.

There’s no inactivity fee, and the platform avoids surprise charges on dormant accounts. This transparency is one reason why trust scores in Gracex reviews remain high despite being a relatively young brand.

Low-cost trading is real at Gracex — at least according to those who’ve tracked their statements.

Automation Tools: Social Copy, PAMM, and More

Gracex extends beyond classic trading by offering social trading and PAMM portfolio management. New users can follow experienced traders, copy their positions, or invest in managed accounts with automated profit distribution. These tools are popular among part-time and novice investors who want exposure without micromanaging trades.

Additionally, the platform provides structured education, trading signals, and market analytics — all aligned with the automation mindset. Tutorials often combine MT5 strategy building with Gracex-specific features like real-time copier settings and risk filters.

Automation at Gracex isn’t just available — it’s integrated and beginner-accessible, as reviews repeatedly mention.

Awards and Industry Recognition: More Than Marketing?

In 2024, Gracex was recognized by several independent financial associations for “Best Customer Support” and “Fastest-Growing Brokerage Brand”. While these may sound like marketing headlines, they reflect a real uptick in verified client activity and positive third-party audits.

These recognitions support the credibility of the broker, especially for traders wary of new names. Gracex reviews cite helpful multilingual support teams and proactive account managers — key areas where other brokers often fall short.

Here too, the positive reviews appear grounded in verifiable milestones — not just PR slogans.

So, What’s True and What’s Just Hype?

Returning to the title — “Gracex Reviews – What Investors Really Think” — we’ve examined all key dimensions: regulation, platform execution, fees, accounts, automation, and client sentiment. The recurring themes are transparency, execution quality, and low entry barriers.

Weaknesses? Some users note delayed withdrawals via certain methods and limited local payment support in specific regions. However, these are logistical — not structural — flaws, and rarely affect overall trust.

Final verdict? Gracex is not perfect, but most positive reviews are backed by actual user experiences and platform capabilities. So yes — Gracex reviews generally reflect real investor sentiment, not just marketing fluff.