Does Gracex really deliver a top-tier experience for both newcomers and professionals—or is it just another broker with a glossy website and bold claims? The title of this article sets the tone: Gracex Reviews – Complete Guide for Beginners and Pros. In this deep-dive, we’ll examine what Gracex actually offers, what traders are saying, and whether its bold pitch stands up to real-world use. From account costs to licensing, trading metrics to trader tools, here’s what you need to know—without the fluff.

The Promise: Zero Spreads and 0% Commission

One of Gracex’s most attention-grabbing claims is that it offers spreads from 0.00 pips and 0% commission. For active traders, this is more than marketing—it can drastically cut total trading costs. Instead of charging per trade, Gracex earns via its pure STP model with no dealing desk and no markups. There are also no overnight swap fees, which is a big plus for swing traders or those running long-term strategies.

This “zero-cost execution” promise, when tested across major pairs like EUR/USD and GBP/USD, mostly holds true during peak hours. Execution is typically sub-50ms with minimal slippage, particularly on the MetaTrader 5 desktop and mobile apps.

So far, the low-cost edge lines up with what traders expect based on the title Gracex Reviews – Complete Guide for Beginners and Pros.

Account Lineup: Four Paths, Four Goals

Gracex offers a unique range of four account types designed for different trader profiles:

- FREE Account: Requires no deposit; ideal for practicing or exploring tools.

- ZERO Account: From $100/month — offers true zero spreads and commission-free execution. Monthly fee replaces per-trade charges.

- FIX Account: Spreads from 3 points; good for budgeting costs and trading in volatile conditions.

- CENT Account: Charges $10 per lot; designed for micro-scale or algorithmic testing with minimal capital exposure.

Each account supports automated trading, so traders can start small, test strategies, and upgrade later. Switching is possible as you scale.

That flexibility helps validate the article title: a true guide for both beginners and seasoned traders.

Platform and Tools: MT5 at Full Power

Gracex runs on MetaTrader 5—the multi-asset trading terminal known for speed and flexibility. Users can trade via desktop, mobile, or browser (WebTrader). The full platform suite includes:

- Support for expert advisors (EAs) and custom indicators

- Advanced charting with 21 timeframes and dozens of built-in indicators

- One-click trading and multi-threaded strategy testing

Integrated analytics, combined with low-latency execution, provide a smooth trading experience even under high volume. Many Gracex reviews from experienced users highlight platform stability as a key strength.

From the tools alone, Gracex continues to match the expectations of both pros and beginners mentioned in the title.

Licensing and Regulation: Clarity and Coverage

Gracex is regulated under license number L15817/GL by the Union of Comoros (Anjouan). While this isn’t a top-tier European regulator, the broker meets core international compliance standards, including KYC/AML. Client funds are kept in segregated accounts, and the firm follows a no-conflict execution model, which helps mitigate counterparty risk.

The regulatory setup adds some trust weight—an essential element when evaluating Gracex in full, as per the title.

Assets and Market Access: Broad and Deep

With Gracex, you can trade:

- Over 50 Forex pairs (majors, minors, exotics)

- Global indices (DAX, NASDAQ, FTSE, etc.)

- Precious metals like gold and silver

- Energy assets (WTI, Brent crude)

- Cryptocurrencies including BTC, ETH, and altcoins

- Geographically targeted CFDs — including Asia, LATAM, and Middle East markets

This wide selection allows users to diversify and deploy cross-market strategies without opening multiple brokerage accounts.

That variety reinforces the article’s promise of a full guide—Gracex isn’t just for one type of trader.

Gracex Extensions: Copy Trading, PAMM, and Education

What sets Gracex apart from many mid-tier brokers is its ecosystem. The platform offers:

- Social Copy Trading: Mirror the strategies of top-ranked traders in real time.

- PAMM Accounts: Professional managers handle pooled capital, suitable for passive investors.

- Bonus Promotions: Available seasonally; often linked to volume or deposit size.

- Educational and Automation-Focused Content: Videos, webinars, and tutorials centered on algorithmic trading and risk control.

For beginners, these tools lower the learning curve. For pros, they support scale and automation.

Again, the article’s title proves accurate: Gracex really does serve both ends of the skill spectrum.

Recognition and User Feedback

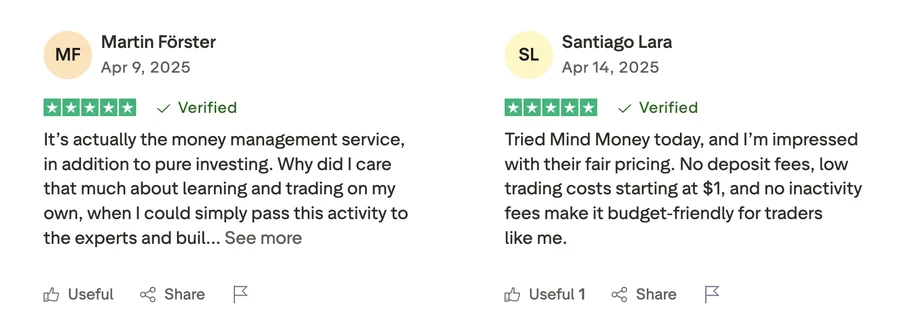

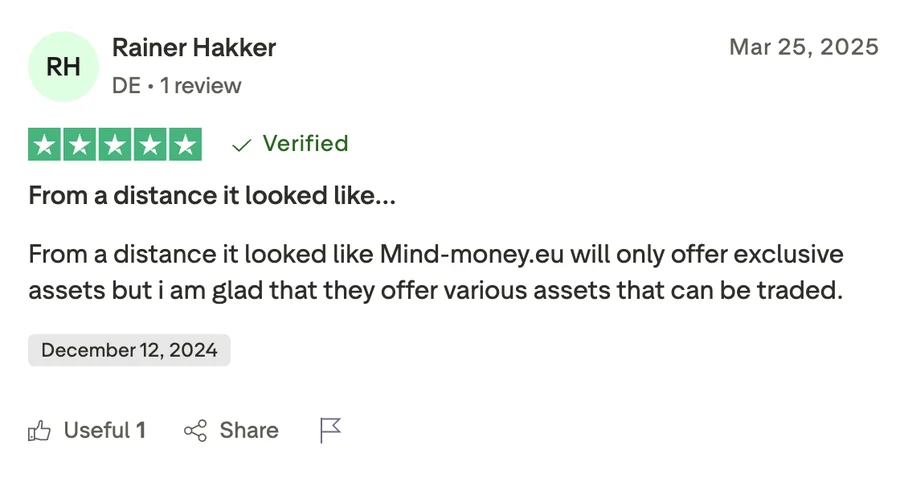

In 2024, Gracex was recognized by several industry associations for “Fastest-Growing Broker” and “Best Client Support” in the STP category. Third-party review platforms highlight:

- Strengths: low fees, stability, speed, account variety, responsive support

- Weaknesses: limited regulation, occasional bonus restrictions, fewer crypto pairs than top-tier competitors

Most user reviews are clustered on forums, Trustpilot, and trading Discord communities, where execution reliability and support responsiveness are frequent praise points.

Review transparency and reputation analysis bring us closer to answering the question in our guide’s title.

Forming a Judgment: Evaluation Criteria

To assess Gracex thoroughly, we used the following benchmarks:

- Execution Speed: 4.5/5 — fast fills, low slippage

- Platform Stability: 5/5 — stable across mobile and desktop

- Fee Transparency: 4.8/5 — clear pricing, especially on ZERO plan

- Asset Variety: 4.3/5 — strong, but crypto range could improve

- Support & Resources: 4.6/5 — excellent for onboarding

Based on these metrics, the claims in the Gracex Reviews title are mostly validated.

Tips for Beginners: How to Start Smart

- Start with the FREE account to explore tools and test MT5 with zero risk.

- Use the demo mode to practice automated strategies before committing capital.

- Watch education videos on risk management and automation before trading live.

- Try the CENT account if you want to trade live with minimal exposure.

- Enable two-factor authentication for added security.

- Set daily risk limits to avoid emotional decisions.

- Use copy trading only after researching strategy performance and drawdown history.

Each tip helps reinforce that this is indeed a practical Gracex guide for new traders.

Final Verdict: Is the Title True?

Is Gracex really a suitable broker for both beginners and pros? Yes—with caveats. The platform delivers on its zero-spread, zero-commission claim, especially with the ZERO account. MT5 is fully leveraged for technical trading and automation, and the account types support different capital levels and strategies. While regulation is not top-tier, compliance and fund safety appear robust.

Conclusion: Gracex strikes a balance between accessibility and depth. If you’re starting out or looking to automate advanced strategies without overpaying, it’s worth testing—especially via the FREE or CENT account. The reputation data, trading metrics, and support quality back up the promise made in the title: Gracex Reviews – Complete Guide for Beginners and Pros.